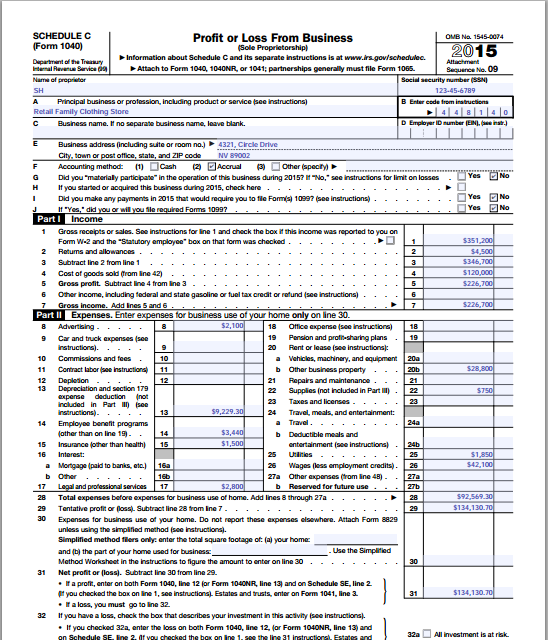

schedule c tax form h&r block

Schedule D Form 1040 is a tax schedule from the IRS that attaches to the Form 1040 US. An activity qualifies as a business if.

Fillable Hnr Block Drop Off Document Checklist Printable Hnr Block Drop Off Document Checklist Blank Sign Forms Online Pdfliner

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

. Individual Income Tax Return Form 1040-SR or Form 1040NR. It is used to help you calculate.

Tax Software For Easy At Home Preparation Filing H R Block

/opengraph-logo-baad7bd4115f444aa63c41f958eb0677.jpg)

H R Block Vs Turbotax Vs Jackson Hewitt

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

How To Report Self Employment Income H R Block

H R Block Tax Software Premium 2020 Digital 1516800 20 Best Buy

H R Block Review 2022 Pros And Cons

Self Employed Online Tax Filing And E File Tax Prep H R Block

Premium Tax Preparation Software H R Block

Tax Software For Easy At Home Preparation Filing H R Block

How To Fill Out Crypto Tax Form 8949 In Hr Block Tax Software 2021 Youtube

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Chapter 7 Solutions Income Tax Fundamentals 2016 With H R Block Premium Business Access Code 34th Edition Chegg Com

H R Block Review 2020 Free Online Tax Filing Software Pros Cons

Where S My Refund Track My Income Tax Refund Status H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

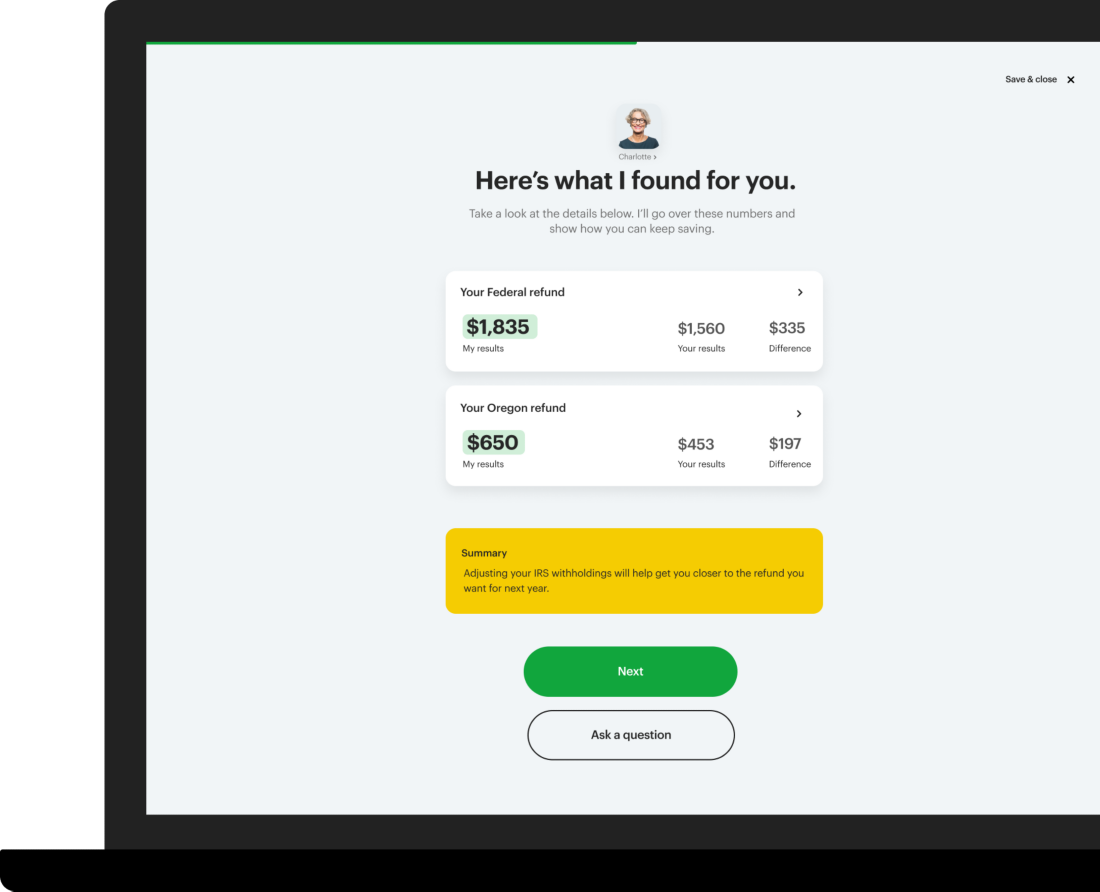

Virtual Remote Tax Preparation Services H R Block

2018 H R Block Business Premium Turbo S Corp Schedule C Tax Cut New Sealed Cd 735290106414 Ebay